Research Brief

Canada Inflation

April 2024

Core Inflation Continues to Trend Down,

Supporting Mid-Year Interest Rate Cut

March inflation reading better than headline metric suggests. Canada’s consumer price index rose 2.9 per cent year-over-year in March, up from a 2.8 per cent gain in February. This inflation uptick matched market expectations, with gasoline prices contributing the most to the year-over-year headline acceleration. Despite the increase in annual price growth seen in March, underlying measures were more favourable. The Bank of Canada’s preferred readings of core inflation continued to trend down for the third consecutive month, which beat the market consensus. CPI-trim slowed to 3.1 per cent from 3.2 per cent in February, while CPI-median decreased to 2.8 per cent from 3.0 per cent. This pulled the average annual rate down to 2.9 per cent, which was the first time since June 2021 that it was within the BoC’s target range. The three-month annualized rate also showed further easing, dropping to just 1.3 per cent.

Financial markets bet on June for first rate cut. In the recent BoC policy announcement, the monetary authority indicated it is seeing welcoming softening in price pressures, but needs to see it for longer. Following the March inflation release, bond yields fell marginally and the Canadian dollar depreciated as ongoing easing in core inflation fits the criteria of further downward momentum in overall price pressures. Interest rate swap markets also increased their bets for a June interest rate cut. Just prior to the inflation release, markets were pricing in a roughly 50 per cent chance, while just after the announcement, that probability jumped to roughly 60 per cent. If materialized, falling borrowing costs will act as a tailwind for both commercial real estate space demand and investor sentiment.

Commercial Real Estate Outlook

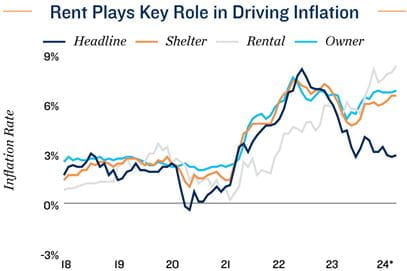

Rising construction costs hindering housing affordability. Canada’s construction sector has faced multiple headwinds since the onset of the pandemic. The disruption of global supply chains caused steep price increases in major building materials and the restructuring of the job market deepened labour shortages, causing construction costs to surge. Annual residential cost growth peaked at nearly 23 per cent in 2022, while non-residential reached roughly 13 per cent. At the same time, rising interest rates compounded these challenges by making financing less accessible. Residential construction investment fell 12 per cent last year, while housing starts also declined 7.0 per cent. This drop in building intentions — combined with historic population growth of 3.2 per cent in 2023 — are the main reasons why rental inflation sat at 8.3 per cent in March and was one of the largest contributors to overall price growth.

Multifamily benefiting from supply-demand imbalance. Given the combination of robust population growth amid historic immigration and slowing construction activity hindering supply growth, apartment rentals are continuing to attract investor interest. The nation’s vacancy rate reached an all-time low of 1.5 per cent in 2023, which pushed annual rent growth to a new high of 8.4 per cent. While population and annual rent growth are set to slow over the coming year due to a recently announced policy capping immigration, both are set to hold above long-term standards. In addition, the federal government recently announced a swath of policies to incentivize multifamily development and investment, which is likely to encourage buyer demand over the coming year.

* Through March

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Bank of Canada; Canada Mortgage and Housing Corporation;

Capital Economics; CoStar Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE