Research Brief

Retail Sales

March 2024

Consumer Budget Tightening Stands to

Benefit a Range of Retail Assets

Consumers' priorities reflected in annual gains. While the 2.2 percent year-over-year gain in total core retail sales reported in February failed to match the 3.8 percent rise in core CPI, three key categories bucked this trend. Rising sales amid moderating or falling prices point to what purchases households are prioritizing amid tightening budgets. Factoring in inflation, apparel sales rose 1.3 percent year-over-year in real terms last month, while electronics and appliance sales grew by 1.9 percent amid a more than 5 percent drop in pricing. Restaurants and bars, meanwhile, registered a 1.8 percent increase in annual sales when factoring in inflation in the segment. Should positive gains continue across these categories, shopping center owners with diverse tenant mixes stand to benefit.

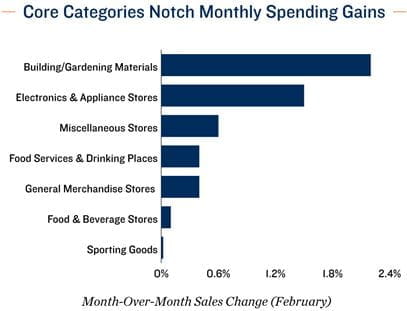

Thrifty consumers positively impact brick-and-mortar sales. President’s Day weekend has historically proven to be one of the key times of the year for consumers to save on big ticket items, as retailers tend to lower prices to make room for 2024 inventory. As such, more households that are enduring a period of budget tightening appear to have penciled this time for discretionary purchases. Electronics and appliance-related spending rose 1.5 percent on a monthly basis in February, the largest gain since July 2022. General merchandise sales were also up, by 0.4 percent, with spending in the category reaching a record mark.

Thrifty consumers positively impact brick-and-mortar sales. President’s Day weekend has historically proven to be one of the key times of the year for consumers to save on big ticket items, as retailers tend to lower prices to make room for 2024 inventory. As such, more households that are enduring a period of budget tightening appear to have penciled this time for discretionary purchases. Electronics and appliance-related spending rose 1.5 percent on a monthly basis in February, the largest gain since July 2022. General merchandise sales were also up, by 0.4 percent, with spending in the category reaching a record mark.

Upward trend continues as consumers rely on dining out. While several discretionary categories snagged the recent spotlight, restaurants and bars remain in positions of strength. Last month, spending rose 6.3 percent year-over-year, with the number of jobs at eating and drinking venues up by 42,000 positions, the largest gain outside of the healthcare and government sectors. Consumers’ prioritization of dining out and experiences is likely to persist in March, aided by St. Patrick’s Day festivities and the NCAA basketball tournament.

Retail Property and Investment Insights

Contrasting dynamics at play. March has been an active period for store closure announcements. Dollar Tree disclosed plans to shed 600 of its Family Dollar locations this year, while Rite Aid and Macy’s are undertaking similar actions, albeit to a lesser extent. Crafts retailer Joann may join this group soon, after filing for bankruptcy this month. Despite these headline-grabbing actions, other retailers are expanding amid a span of record-low vacancy. Target intends to open 300 stores over the next 10 years, while Aldi will expand by 800 locations in half that time. Ross and Grocery Outlet are also growing, with plans to open 90 and 20 stores, respectively, in 2024.

Subsector warrants buyers' attention. Often featuring diverse tenant bases, unanchored strip centers may gain in appeal among buyers moving forward. The subsector, which includes properties ranging from 10,000 to 50,000 square feet, entered the year with 4.7 percent vacancy, its lowest recording since 2003. The asset type also has a minimal active pipeline and offers tenants an average asking rent well below the retail sector’s overall mean.

0.3% |

2.2% |

|

Month-Over-Month Rise in Core Retail Sales* |

Year-Over-Year Rise in Core Retail Sales |

* Core retail sales exclude auto and gasoline purchases

Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics; U.S. Census Bureau

TO READ THE FULL ARTICLE