Research Brief

Inflation

March 2024

Fed Maintains Caution; Real Estate Investment

Gradually Gaining Momentum

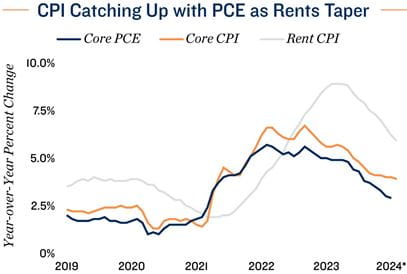

Inflation trends cloud Fed's path. Still-elevated inflation is leading Wall Street participants to delay expectations for the Federal Reserve to start cutting interest rates this year — shifting from spring to summer. Alongside strong hiring in the opening months of 2024, February's higher headline CPI reading contributed to the Federal Open Market Committee's decision to hold the federal funds rate at a 5.25 percent lower bound in March. Fortunately, core CPI, which strips out the more volatile food and energy indices, cooled year-over-year for 11 straight months through February 2024, marking the longest uninterrupted period of disinflation since 1975. Even as headline inflation remains bumpy, lessening core pricing pressures should enable the Fed to begin cutting interest rates this year. While the first cut will be impactful, the second will signal the start of a new monetary policy cycle to real estate investors, spurring renewed deal-making activity.

Retail discounts impact core inflation. A crucial piece to core inflation's cooling has been more stable costs for consumer discretionary goods. The price level of the commodities index, excluding energy and food, fell 0.3 percent over the 12 months ended in January 2024 and remained on the decline in the following month. As the index has not charted into negative territory since July 2020, easing goods prices reduced pressures on consumer budgets. Flat, and even declining prices for several commodities, led by apparel and vehicles, contributed to core retail sales growing 2.2 percent year-over-year in February. While some retailers discounting in recent months to make way for new inventory may have supported this dynamic, the longer trend over the past year reveals shoppers' selectivity toward discounts. This may bode well for the value segment of retailers in the near-term.

Retail discounts impact core inflation. A crucial piece to core inflation's cooling has been more stable costs for consumer discretionary goods. The price level of the commodities index, excluding energy and food, fell 0.3 percent over the 12 months ended in January 2024 and remained on the decline in the following month. As the index has not charted into negative territory since July 2020, easing goods prices reduced pressures on consumer budgets. Flat, and even declining prices for several commodities, led by apparel and vehicles, contributed to core retail sales growing 2.2 percent year-over-year in February. While some retailers discounting in recent months to make way for new inventory may have supported this dynamic, the longer trend over the past year reveals shoppers' selectivity toward discounts. This may bode well for the value segment of retailers in the near-term.

Several services becoming more expensive. Inflation for several services accelerated, contrasting commodity pricing trends. The transportation and hospital services indices grew 9.9 and 1.4 percent over the year ended in February, each at least three-month highs. Paired with strong hiring during the month, these elevated costs suggest service workers' hourly wages may still be pushed up by sustained labor demand in 2024. While the dynamic may be inflationary, it bodes well for household formation, retail spending and tenant demand across the commercial real estate spectrum. Apartment net absorption is expected to increase in 2024 amid improving household growth.

Shelter costs coming down considerably. Despite stubbornly-high overall services inflation, price increases for the largest component, housing expenses, are slowing. Most notably, the index for rent grew 5.8 percent over the year ended in February, marking the measure's lowest reading since May 2022. Apartment rent growth continues to level off from 2021 and 2022's record highs, with more than 400,000 units slated for completion for the second consecutive year. Recalibration is concentrated along highly-supplied Sun Belt markets, however, with average effective rent growth in lower-construction areas like San Diego and Baltimore still expected to accelerate in 2024.

Housing expenses inflate CPI. The core PCE index, another inflation indicator, is less influenced by housing costs and rose by just 2.8 percent over the year ended January 2024. This lower reading suggests that, as housing expense growth eases over time, the CPI measure will cool similarly. Still, the Fed wants to see a sustained period of lower pricing pressures before it cuts rates. While updated projections from FOMC members imply 75 basis points of cuts this year, that is not a formal stance and timing could change.

3.2% |

3.8% |

|

Increase in Headline CPI Year-Over-Year |

Increase in Core CPI Year-Over-Year |

* CPI measures through February, Core PCE through January

Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics; CME Group; Federal Reserve;

RealPage, Inc.; Census Bureau; Bureau of Economic Analysis; CoStar Group, Inc.

TO READ THE FULL ARTICLE