Research Brief

Employment

March 2024

Resilient Job Growth With Uptick in

Unemployment Could be the Perfect Mix

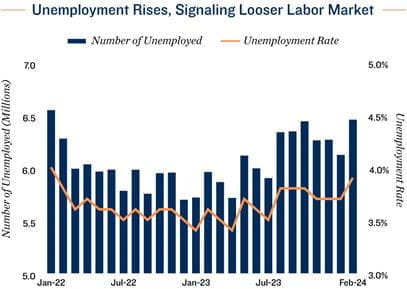

Rising unemployment releases pressure on inflation. Employment growth accelerated in February with 275,000 jobs created, yet the unemployment rate also rose by 20 basis points to 3.9 percent. While the highest rate of unemployment in 25 months may be interpreted as a negative signal, in this case some labor market softening could be a positive sign, especially when paired with healthy employment growth. After more than two years of sub-4 percent unemployment, the additional 150,000 people joining the labor pool last month should help ease staffing bottlenecks, and signal positive hiring momentum in the coming months. A looser labor market will also help reduce the upward pressure on inflation from personnel shortages. Core PCE inflation slowed to 2.8 percent year over year in January, below the rise in average hourly earnings, implying an increase in real incomes.

Consumer optimism reflected in retail spending and job growth. Inflation holding below wage growth has helped bolster consumer activity at retail stores as well as bars and restaurants, prompting increased hiring efforts. Employment at food services and drinking places climbed by 42,000 roles in February, the largest increase outside of the healthcare and government sectors, which are less tied to the business cycle. The number of retail trade positions also rose by 19,000 last month as store-based sales hover near all-time highs. The spending and hiring dynamics are having positive downstream impacts on retail property performance. The national retail vacancy rate exited 2023 at a record low 4.5 percent, and with major tenants such as Dutch Bros and Aldi planning expansions, momentum should carry through this year.

Consumer optimism reflected in retail spending and job growth. Inflation holding below wage growth has helped bolster consumer activity at retail stores as well as bars and restaurants, prompting increased hiring efforts. Employment at food services and drinking places climbed by 42,000 roles in February, the largest increase outside of the healthcare and government sectors, which are less tied to the business cycle. The number of retail trade positions also rose by 19,000 last month as store-based sales hover near all-time highs. The spending and hiring dynamics are having positive downstream impacts on retail property performance. The national retail vacancy rate exited 2023 at a record low 4.5 percent, and with major tenants such as Dutch Bros and Aldi planning expansions, momentum should carry through this year.

Distribution and warehouse properties face mixed outlook. The same factors influencing hiring at bars and restaurants are at play in the transportation sector, where staff counts rose by roughly 26,000 in February. Online consumer spending as a share of core retail sales hit a new record in January, excluding 2020, fueling the need to deliver goods to customers quickly. The number of roles in warehousing and storage fell by 7,000, however, revealing divided implications for industrial properties. Companies are readjusting warehouse footprints after keeping outsized inventories during pandemic-era supply chain issues. Combined with elevated construction, this mixed demand environment will mean a second year of rising vacancy.

Financial Market Implications

Higher unemployment rate could reassure the Fed. The first increase to the unemployment rate in four months, paired with less job growth in December and January than initially reported, could be the labor market softening signal that the Federal Reserve has watched for. The Fed has heavily implied that it will not lower the overnight lending rate at the March meeting, a message that Wall Street has taken to heart with only a 3 percent expectation of a cut. Yet, the loosening job market may underpin a decision to do so later in the year, especially if inflation continues to cool. The core PCE index has increased by a monthly average of 0.2 percent since August. If that pace were maintained for the rest of this year, it would produce annual inflation of 2.4 percent, very close to the Fed’s long-run target of 2.0 percent.

Evidence of rate cut pattern key to supporting sales activity. While a reduction to the Federal Funds rate would somewhat ease borrowing costs, confidence that the Fed will loosen monetary policy will likely not gather until at least the second cut. A lower benchmark rate, together with the potential for lenders to bring in spreads slightly, would go a long way toward accelerating the alignment process for the pricing expectations of buyers and sellers of commercial real estate that is currently underway. The recent stability in the 10-year Treasury, which has held in the low-4 percent range since mid-January, would also aid investment sales activity if it were to continue.

CME Group; Federal Reserve; Moody’s Analytics; Real Capital Analytics

TO READ THE FULL ARTICLE