Research Brief

Canada Retail Sales

March 2024

Core Retail Sales Inch Higher as Households

Exhibit Broad-Based Spending

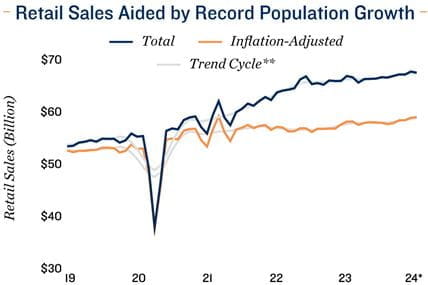

Consumption up as prices ease. The 0.3 per cent drop in total retail sales values in January belies underlying consumer strength. The slight decline was fueled in large part by a 2.4 per cent drop in motor vehicle and parts dealers sales. While high interest rates are one factor contributing to this slight pullback, the decline was also a result of temporary weakness in motor vehicle manufacturing amid some major auto plants undergoing repairs. Core retail sales, which exclude gasoline and motor vehicle-related spending, jumped 0.4 per cent in the month. In addition, after controlling for inflation — which fell in January as prices moved lower — sales volumes rose 0.2 per cent, translating into a 1.5 per cent annual gain. This strong showing in yearly sales points to Canada’s rapidly rising population, which grew at a historic pace of 3.2 per cent annually as of October 2023. Newcomers have kept retail sales on a positive trajectory despite per capita spending trending down over the past year.

Estimates suggest further economic growth ahead. January’s 0.2 per cent monthly gain in inflation-adjusted retail sales was larger than expected. This strong showing, along with preliminary estimates suggesting further growth in February, provides an early indication that Canada’s economy is likely to continue to grow in the first quarter of 2024. Combined with historic population gains and the expectation that interest rates will fall, Canada’s economy could slowly build momentum over the latter parts of this year and outperform in 2025. This overall boost to economic activity will support space demand across the commercial real estate property spectrum and help build positive investor sentiment.

Commercial Real Estate Outlook

Suburban retail outperforming. After years of hybrid work re-establishing office norms, the return of in-person work has not materialized as fast as some expected. Consequently, foot traffic in downtown markets — while slowly rising — remains below pre-pandemic levels. This can be seen in the 22 per cent drop in public transit passenger trips over the trailing 12 months ending in January when compared to the year leading up to the health crisis. In contrast, foot traffic for more suburban areas has increased. Hybrid work has allowed people to relocate to more affordable regions and a growing number of these residents are spending more time shopping closer to home. In addition, ongoing affordability challenges have directed many current residents and newcomers to regions that offer a lower cost of living, which tend to be located outside of urban cores. As a result, vacancy rates for suburban markets are not only lower but have been trending down at a faster pace than downtown areas.

Online shopping activity sees strong gain. E-commerce sales rose 3.5 per cent monthly in January, which translated into a 12.6 per cent annual gain — both of which were the largest increases since March 2023. As a result, online shopping as a percentage of total retail sales inched up to 5.7 per cent, nearly double the pre-pandemic average. While an influx of new industrial supply — along with moderating demand amid high interest rates curbing both business and consumer spending — is forecast to push vacancy up over the coming year, underlying fundamentals are expected to remain healthy. This will continue to generate positive investor sentiment and cause industrial properties to remain a preferred investment option.

* Through January; ** Smoothed version of seasonally adjusted time series

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics;

CoStar Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE