Research Brief

Retail Sales

February 2024

Necessity-Driven Spending Underscores

Tight Vacancy for Retail Subsectors

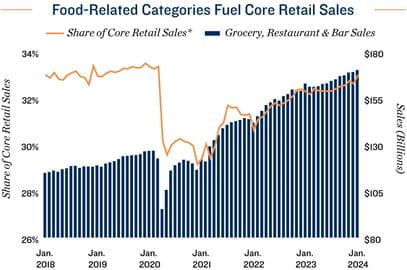

Dual retail categories buck the larger trend. In January, for the first time since March of last year, core retail sales fell on a monthly basis, a reflection of more consumers avoiding big-ticket, discretionary purchases. The 0.5 percent decline in core spending, however, overshadowed sales at restaurants and bars, as well as grocery stores, which each rose in both real and nominal terms last month to record levels. Collectively, the two categories accounted for 33 percent of all core retail sales, returning to the 2019 monthly average. This indicates that more consumers are prioritizing dining out and necessity items during a period of budget tightening. The segments’ share of core sales is a welcome sign for retailers that operate in these sectors, bolstering the outlook for both single-tenant net-lease and grocery-anchored properties.

Lower cost dining chains respond to consumers' choices. The restaurants and bars segment continues to stand out among retail categories. Spending was up 6.3 percent in January on an annual basis, with a group of drive-thru and fast casual chains reporting above trend year-over-year gains. In response, companies are plotting notable growth, including Jersey Mike’s and Chipotle, who each plan to open more than 300 locations nationwide this year. Raising Cane’s, Bojangles, and Dutch Bros also rank among the top expansion-minded chains.

Lower cost dining chains respond to consumers' choices. The restaurants and bars segment continues to stand out among retail categories. Spending was up 6.3 percent in January on an annual basis, with a group of drive-thru and fast casual chains reporting above trend year-over-year gains. In response, companies are plotting notable growth, including Jersey Mike’s and Chipotle, who each plan to open more than 300 locations nationwide this year. Raising Cane’s, Bojangles, and Dutch Bros also rank among the top expansion-minded chains.

Shift to value underway. An increase in patronage at discount grocers is partially responsible for the 2.3 percent annual rise in supermarket sales during January. In 2023, Grocery Outlet and Aldi, stores that offer lower price goods, noted 10.1 and 7.6 percent rises in annual foot traffic, respectively. As such, both companies are executing expansion plans in 2024, primarily via acquisitions expected to close in the first half. This month, Grocery Outlet announced plans to purchase United Grocery Outlet, a 40-store chain, while Aldi will acquire Southeastern Grocers.

Fed Policy and Retail Investment Insights

Hold likely over the immediate term. At its late January meeting, the Federal Open Market Committee opted to hold the federal funds rate at a 5.25 percent lower bound. The rate has been at this level for six months. While annual core PCE inflation has cooled to 2.9 percent, it remains above the Fed’s 2 percent target, with the FOMC needing further evidence of tapering before a rate cut is considered. Still, it is widely anticipated that the Fed will ultimately cut rates at some point in 2024, although Chairman Powell stated his skepticism of a rate cut at the next meeting in March.

Retail warrants attention. The potential for modest interest rate cuts later this year and encouraging spending at necessity-based retailers may enhance the attractiveness of retail investment. Specifically, single-tenant net-leased assets and grocery-anchored shopping centers may grow in appeal among investors at a time when vacancy in these categories is historically low. Active buyers seeking upside may target centers with recent big-box moveouts, confident in their ability to backfill these spaces over the near term.

2.2% |

4.5% |

|

Annual Rise in Core Retail Sales* |

Annual Rise in Grocery/Restaurant & Bar Sales |

* Core retail sales exclude auto and gasoline spending

Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics;

Placer.ai; U.S. Census Bureau

TO READ THE FULL ARTICLE