Research Brief

Employment

February 2024

January’s Strong Job Growth Shines Light on Office and Industrial Sectors

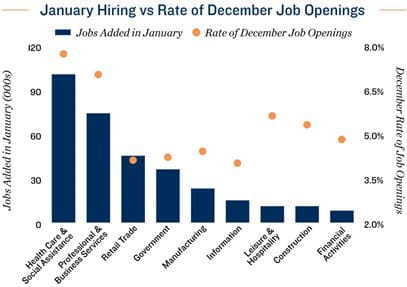

The year kicks off with strong job growth. Total employment rose by 353,000 in January, the largest increase since the same month in 2023, and similar to the 333,000 roles added in December. Unemployment held steady at 3.7 percent for the third month in a row despite this increase. Job gains predominantly occurred in professional and business services, health care, and retail trade, but the manufacturing sector also logged notable hiring after a static environment in 2023. Employment gains in these sectors suggest a brightening outlook for office and industrial commercial properties in 2024.

Hiring and stricter in-person policies a welcome sign for offices. The professional and business service sector added 74,000 jobs in January, a significant uptick from the monthly average of 14,000 recorded last year. This increase is not entirely unexpected, however, as office real estate in the fourth quarter saw its first period of positive net absorption since mid-2022. Professional, scientific and technical services — which are typically in-person roles — accounted for most of January’s gain. As companies that occupy life science buildings demonstrate a willingness and ability to grow, they may generate additional office demand in 2024. Furthermore, stricter in-person policies from companies like Kroger and IBM that will be implemented in the coming months suggest that office-using employment may once again be emerging as a signal for space demand. Nearly half of the 70,000 health care jobs created last month were also in ambulatory services, which are typically based in doctors’ offices. This is a tailwind for medical offices, which have been hindered by a long labor shortage. Total health care hiring including social assistance accounted for over 100,000 new roles in January.

Hiring and stricter in-person policies a welcome sign for offices. The professional and business service sector added 74,000 jobs in January, a significant uptick from the monthly average of 14,000 recorded last year. This increase is not entirely unexpected, however, as office real estate in the fourth quarter saw its first period of positive net absorption since mid-2022. Professional, scientific and technical services — which are typically in-person roles — accounted for most of January’s gain. As companies that occupy life science buildings demonstrate a willingness and ability to grow, they may generate additional office demand in 2024. Furthermore, stricter in-person policies from companies like Kroger and IBM that will be implemented in the coming months suggest that office-using employment may once again be emerging as a signal for space demand. Nearly half of the 70,000 health care jobs created last month were also in ambulatory services, which are typically based in doctors’ offices. This is a tailwind for medical offices, which have been hindered by a long labor shortage. Total health care hiring including social assistance accounted for over 100,000 new roles in January.

Manufacturers reverse the 2023 trend of stagnant headcounts. After several major strikes last year affected hiring activity, employment in manufacturing edged up in January with a 23,000 role gain. The labor disruptions may have led some companies to hold off on space expansions, slowing the pace of industrial net absorption in 2023, but the uptick in hiring indicates that space demand is likely to reaccelerate in 2024. This trend will also help counterbalance the vacancy impact created by 360 million square feet of new supply coming online by December. Additionally, while some larger firms like Amazon have offered space up for sublease, others like Conair and DrinkPAK have quietly expanded their footprints by millions of square feet.

Slow industry hiring could impact hotel occupancy. In January, the leisure and hospitality sector added just 11,000 jobs and the sector remains 75,000 positions short of its February 2020 high. Additions in January did not keep pace with job openings. The sector accounted for 11 percent of open positions according to recent data. This suggests employers are having difficulty finding personnel, which could be a challenge as travel demand is unlikely to slow meaningfully in 2024. The gap between hospitality job openings and hiring may prevent operators from meeting full capacity as they contend with labor shortages, generating subsequent occupancy headwinds.

Wage growth factors into upcoming monetary policy decisions. At its January meeting, the Federal Open Market Committee held the federal funds rate steady at a 5.25 percent lower bound for the fourth consecutive time. While Federal Chairman Jerome Powell indicated that a rate cut at the committee’s March meeting is unlikely, he did point to several positive indicators the FOMC is watching in the labor market, like the Employment Cost Index increasing just 0.9 percent last quarter, nearing a level economists expect is consistent with a 2 percent inflation target. This is aided by fewer quit-related separations in 2023 and, without wage pressure on prices, continued encouraging inflation data is likely. While improbable in March, interest rate cuts are expected in 2024, which will improve commercial real estate lending activity.

Moody’s Analytics; RealPage, Inc.

TO READ THE FULL ARTICLE