The Industry Leader

in 1031 Exchanges

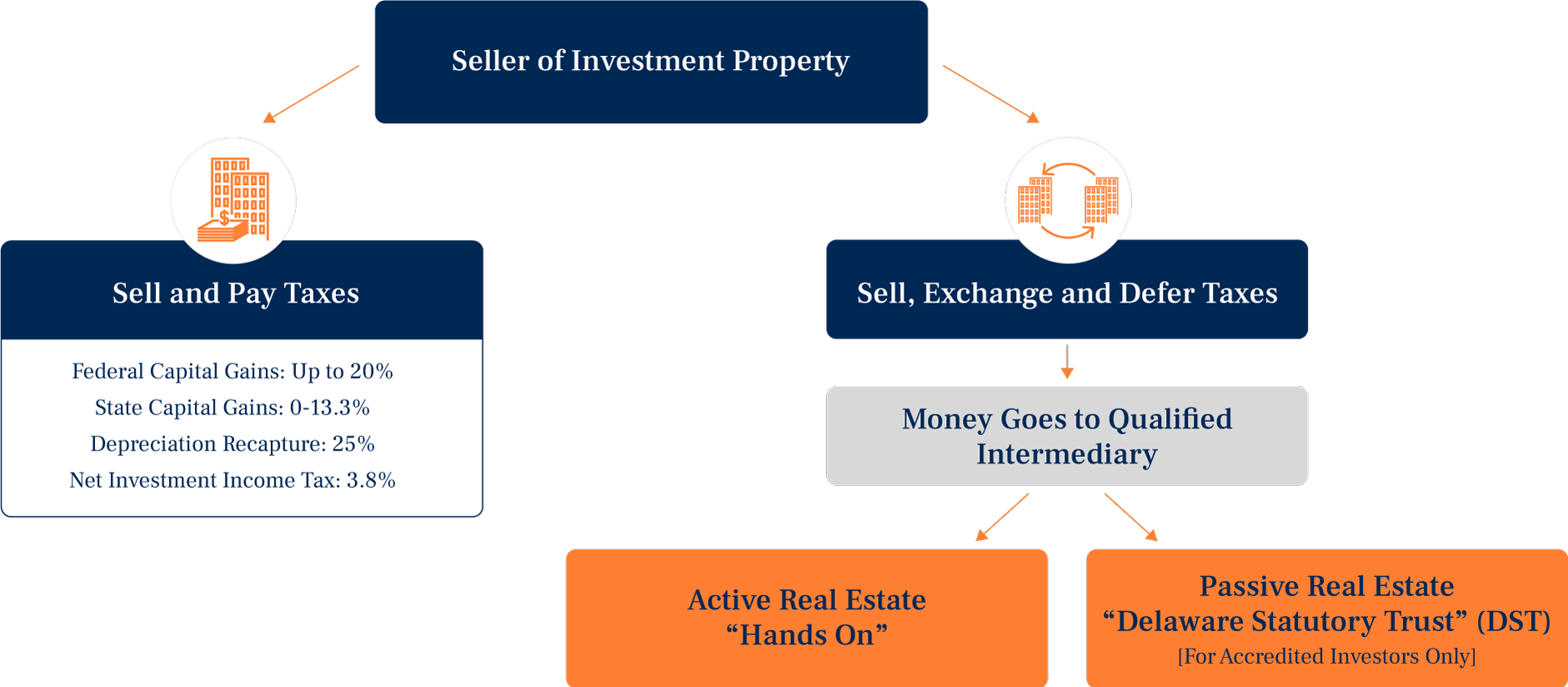

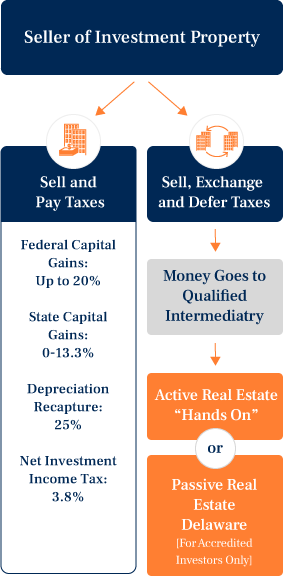

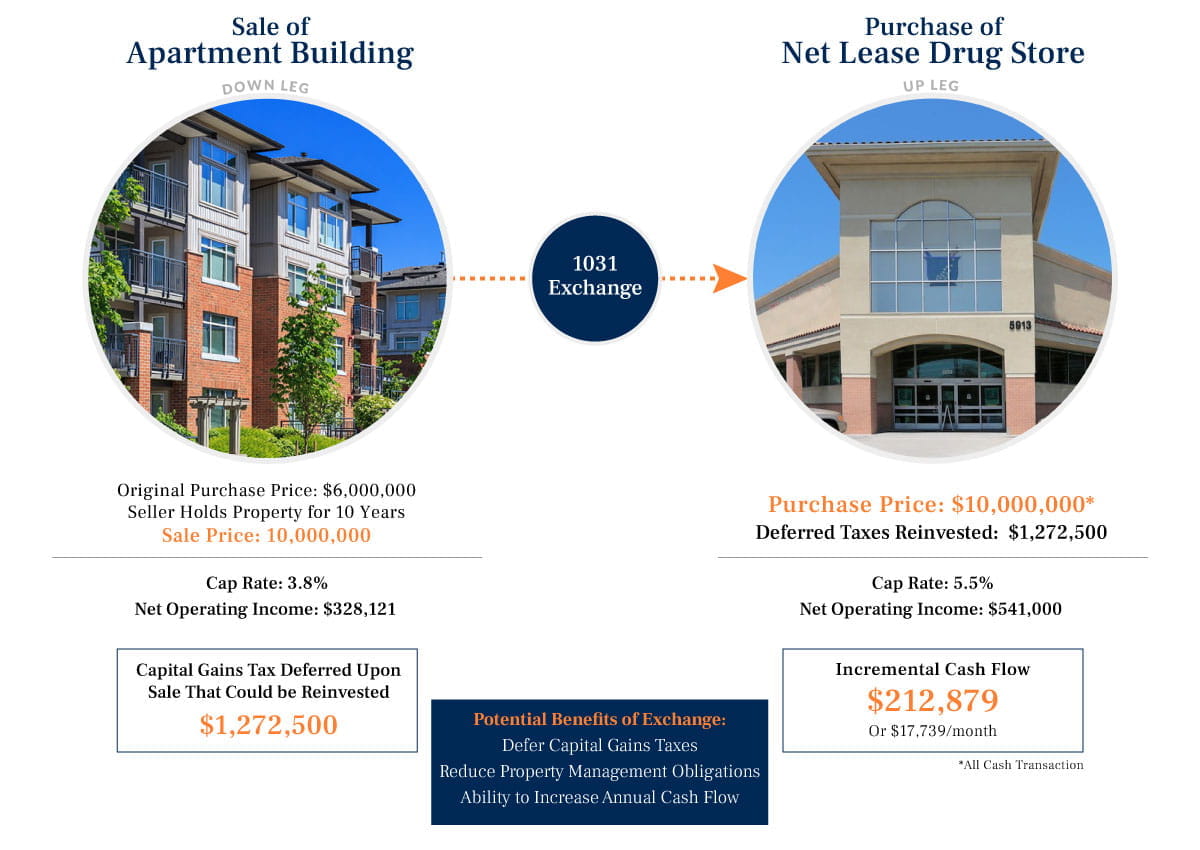

A 1031 exchange is a way to defer capital gains taxes by rolling the equity from the sale of one investment property into the purchase of another. Many real estate investors seeking to increase their returns or reduce their management responsibilities opt for a 1031 exchange to achieve their retail and industrial property investing goals.

Marcus & Millichap is the 1031 exchange industry leader, executing more tax-deferred exchanges than any other firm, thanks to our vast inventory of commercial real estate listings and our culture of collaboration and information-sharing.

What is a 1031 Exchange?

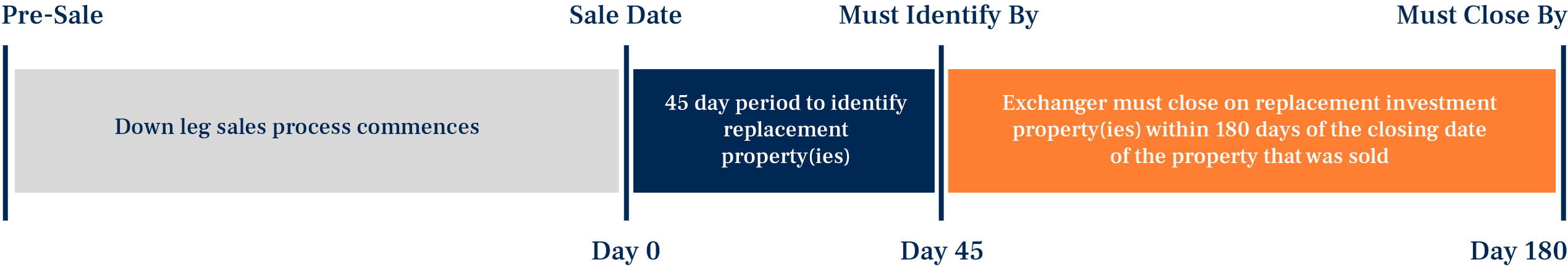

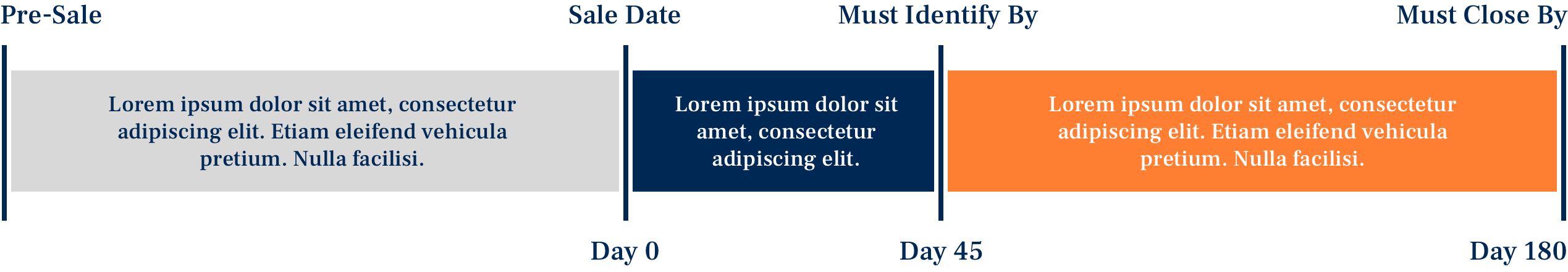

Instead of immediately paying capital gains on the sale of a property (the “down leg”), many investors prefer to defer that payment by purchasing a new commercial property (the “up leg”) with the proceeds. This is commonly referred to as a 1031 exchange, in reference to the section of U.S. tax code that defines it. There are specific rules and timelines related to a 1031 exchange, and it is important to have an experienced and knowledgeable commercial real estate broker handling the process.

1031 Exchange Timeline

Lay the

Groundwork

Speak with your real estate, financial and tax advisors to understand the timelines and restrictions and enlist a qualified intermediary to facilitate the transaction.

Sell a

Property

The real estate advisors at Marcus & Millichap have access to the largest pool of qualified buyers in the industry, helping you sell your commercial property quickly and at a good price.

Identify

Replacement

You have a limited time to make your next transaction, purchasing up to three replacement properties. Marcus & Millichap has the largest inventory of 1031 exchange properties for sale, giving you a range of excellent up leg options.

Purchase

As the market leader in 1031 exchanges and in overall transactions, Marcus & Millichap has the experience and expertise to guide you through the closing process successfully and painlessly.

Report

Exchange

Your tax advisor must report the exchange on your tax return for the year in which you sold your down leg property.

The materials and resources provided on this website have been secured from sources Marcus & Millichap believes to be reliable, but Marcus & Millichap makes no representations or warranties, expressed or implied, as to the accuracy of the information. This website is intended to be used for informational and illustrative purposes only and is not intended to provide, and should not be relied upon for, investment, accounting, legal, or tax advice. Marcus & Millichap and its affiliates, brokers, agents, and capital markets advisors cannot and will not provide any such advice relating to a 1031 exchange. You are admonished to consult with an expert when doing a 1031 exchange. You should not rely upon any of the materials and resources provided on this website for individual investment analysis and decisions. Always seek advice from the appropriate professionals before making any investment decision.

Is a 1031 Exchange Right for You?

While a 1031 exchange is the right decision for many real estate investors, there are many rules and deadlines associated with it, and it’s important to work with experienced specialists. Our highly trained advisors bring years of expertise to every transaction, helping you execute your 1031 exchange flawlessly.